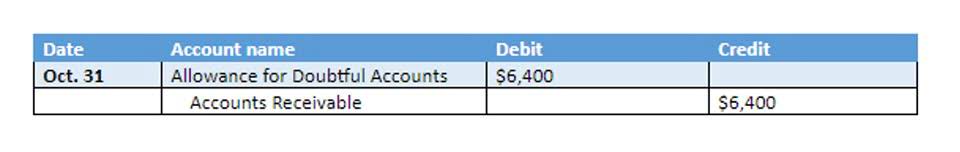

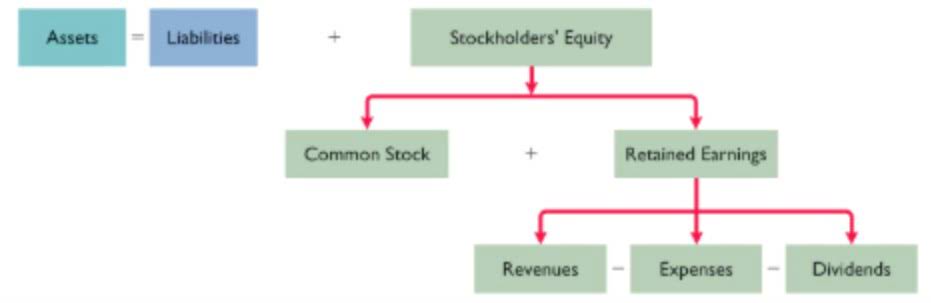

Double-entry bookkeeping requires that all accounting transactions have equal debits and credits. Accountants may use different types of trial balances for specific accounting tasks at different times. A trial balance is a list of all the balances in the nominal ledger accounts.

Spreadsheet or ledger

Look for an entry in your account called ”ending balance,” ”previous ending balance,” or ”beginning balance.” Enter this figure on your form or spreadsheet. Get more from a personalized relationship offering no everyday banking fees, priority service from a dedicated team and special perks and benefits. Connect with a Chase Private Client Banker at your nearest Chase branch to learn about eligibility requirements and all available benefits. Open a savings account or open a Certificate of Deposit (see interest rates) and start saving your money. If you find fraud or a bank error, contact the bank immediately to contest the problematic transaction—otherwise, you might have to live with the problem.

How to balance accounts

Liabilities include Accounts Payable, Accrued Liabilities, Short-term Portion of Notes Payable, Notes Payable-Long Term, and Deferred Revenues. Shareholders’ Equity Accounts in the balance sheet include Retained Earnings, Paid-In Capital, Treasury Stock, and Accumulated Other Comprehensive Income (Loss). A trial balance document is often referred to as a trial balance report. This trial balance example includes an image and a description of a trial balance. Barbara is a financial writer for Tipalti and other successful B2B businesses, including SaaS and financial companies. She is a former CFO for fast-growing tech companies with Deloitte audit experience.

How to balance a checkbook in 5 simple steps

- From organizing your receipts to matching your balance with your bank’s records, we’ll cover everything you need to make this task easy and stress-free.

- It’s a good idea to set aside a certain time at least once a month as you get started.

- The temporary account is closed for the period by transferring the balance to the income statement.

- You may already record the checks you’ve written in your check register, but there are additional ways to track the activity in your accounts.

- Regularly balancing your checking account offers numerous benefits that go beyond just keeping your finances in order.

Many banks offer online banking tools and mobile apps for real-time tracking and alerts for transactions. More often than not, you can view all your account transactions by signing in to your online banking portal. To “balance a checkbook” https://www.facebook.com/BooksTimeInc/ — in its literal and maybe old-fashioned sense — means going through your bank statement and checking each transaction against what you’ve recorded in your check register.

- In a double-entry account book, the trial balance is a statement of all debits and credits.

- With online and mobile banking apps, you may be able to get real-time access to your accounts and get notifications when your bank account is at risk.

- When she’s not writing, Barbara likes to research public companies and play Pickleball, Texas Hold ‘em poker, bridge, and Mah Jongg.

- These apps link to your checking and other financial accounts (including credit cards and savings accounts) and automatically record new transactions for you.

- And although the business is exposed to trade and logistics risks, its long-term growth potential remains strong.

Focusing on debt repayment and savings can help maintain healthy account balances and improve your overall financial health. Prioritize paying off high-interest debt and building an emergency fund to ensure financial stability. Regularly reviewing account statements is a fundamental strategy for managing account balances.

Along with allowing you to easily record lots of different types of transactions, these digital tools also can help you budget and do the math for you — things a checkbook register can’t do. By regularly balancing your checking account, you can spot discrepancies, catch potential errors, and safeguard against unauthorized transactions. This practice is essential for maintaining control over your finances and avoiding costly overdraft fees or financial missteps. how to balance accounts Balancing your books is a critical step for your business in terms of knowing where your finances are at. We’ve looked at four steps that you should follow to help you balance your books well. Then, you can rest assured that you understand your finances fully, the level of income that you’re seeing, and the expenses that are made.

Unadjusted Trial Balance

Considering that the average overdraft fee is around $35, it is better off avoided as much as possible. If you’ve combed through your account statements and still can’t get your checkbook to balance, you should call your bank to ask about any pending debit or credit charges you may have overlooked. Bookkeepers typically scan https://www.bookstime.com/ the year-end trial balance for posting errors to ensure that the proper accounts were debited and credited while posting journal entries. Internal accountants, on the other hand, tend to look at global trends of each account.

Step 4: Use a Chart for Keeping in Check with Your Accounts

This gives you the flexibility to manage your financial tasks on the go, reducing the time and effort required for this task. Still, balancing a checkbook can be a valuable exercise if it helps you monitor your spending, allowing you to detect fraud and avoid overdrafts. If you’re using the checkbook register method and comparing transactions with your account statement, you should balance your checkbook every month.